Payday loans, also known as short term loans, are often perceived as a modern concept, but this isn’t exactly the case. Examples of borrowing money and repaying at a later date can be traced all the way back to the 8th century (and perhaps even earlier). From hawala (see below) to your typical online payday loan, we look at how the industry has transformed over time.

What is Hawala?

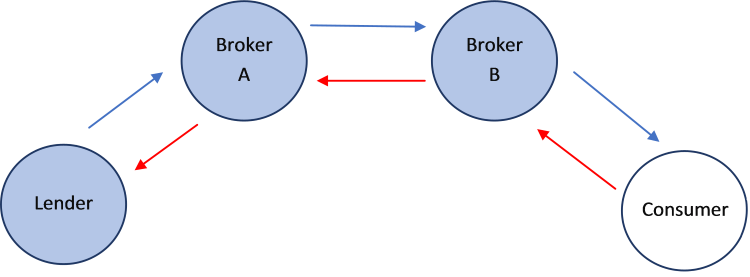

Hawala is a traditional money transfer service which originated in Arab and Muslim countries and relies on the honour and trust between the lender, broker and consumer. In its simplest form, halawa can be explained in the diagram below:

The lender gives money to broker A, who contacts broker B, who gives his money to the consumer.

Broker A then pays broker B and when broker B gets repaid by the customer, he will repay the money to broker A who eventually returns the money to the lender. Of course, there is usually some form of commission within all these transactions, and so the consumer typically repays more than he borrowed – and thus derives the principles of 21st century payday loans.

Hawala is still a system that is used today although variations of it have been banned in certain parts of the world, for example Pakistan, India and some states in America, due to the ease of money laundering and tax avoidance that can be achieved through a ‘cash in hand’ form of monetary transfer.

How has money lending changed over time?

Over time, money lending saw some big changes. Banks became more accessible to the public, not just the richer, upper class, in the 1920s following the First World War, however references and documents were still required to open an account – let alone take out a loan, so bank loans still weren’t an option for everyone as they were difficult to obtain.

Pawnbrokers

Pawnbrokers

Because bank loans were unreachable for most people, other forms of borrowing started to surface. The 1930s saw the introduction of pawnbrokers which grew as an industry right through to the 50s. Pawnbrokers are still around and operate in the exact same way although they tend to be less preferable to modern payday loans. A customer will take an item of value to a pawnbroker who lends them money in return. The item acts as collateral if the borrower fails to repay the loan as the pawnbroker will simply sell the item to make his money back. The potential loss of a valuable item to the customer is why pawnbrokers are often used as a last resort.

Cash chequing

Cash chequing

Another form of borrowing that became popular around the 70s was cash chequing. This was similar to how a pawnbroker operates in that when the loan repayment was due, the lender would receive their repayment, despite the financial position of the customer at the time. The difference with cash chequing is that instead of a valuable item, a cheque which had been signed and dated would get cashed in on the repayment date. This left little control over whether the repayment was made by the borrower, which is probably why cash chequing fell out of fashion with the beginning of payday loans in the 1990s. However, it did mean the borrower didn’t have to put up collateral and risk losing valuable items.

When were payday loans established?

In the 1980s, banking finally became an option for a much larger audience – almost anyone could now open a bank account, and with the use of credit on the rise borrowing became a normality, however it still wasn’t available to everyone.

With the turn of the decade and the end to the 80s, payday loans were established. Payday loans, also known as bad credit loans, offered privacy and informality to consumers who previously had no borrowing options. When the World Wide Web was introduced and more widely used, payday lenders flourished because they could now offer their service to a much wider audience, and the whole process could be completed in minutes. Because of the speed of transferring a loan, and the privacy the internet provided, the likes of cash chequing and pawnbrokers diminished even more.

What has been the result of payday loans?

Same day loans became very popular, and unfortunately many overused them resulting in large-scale debt. While regulated, lenders still had a lot of freedom in how they operated, and often appropriate affordability checks were not carried out. Further to this, methods of debt collection were somewhat controversial. By 2014, the industry was massive, and so was its reputation.

In 2014, the Financial Conduct Authority took over the regulation of the consumer credit industry and enforced much stricter rules. Many practices were forced to close because they could no longer compete under the new regulations. The results of these regulations were reviewed a year later in 2015 and it was decided both the consumer and the lender were better protected against irresponsible lending and irresponsible borrowing. Slowly, payday loans were starting to sound less intimidating, but the damage of the pre-2014 industry will reign over the high acceptance loan industry for some time to come.

At cashasap.co.uk, we are an FCA authorised and regulated direct lender. We take responsible lending very seriously and try to offer the best possible service in the interest of our customers. If you would like to learn more about what a payday loan is, click here.